Tail Hedge Combined with Long-term Profitability

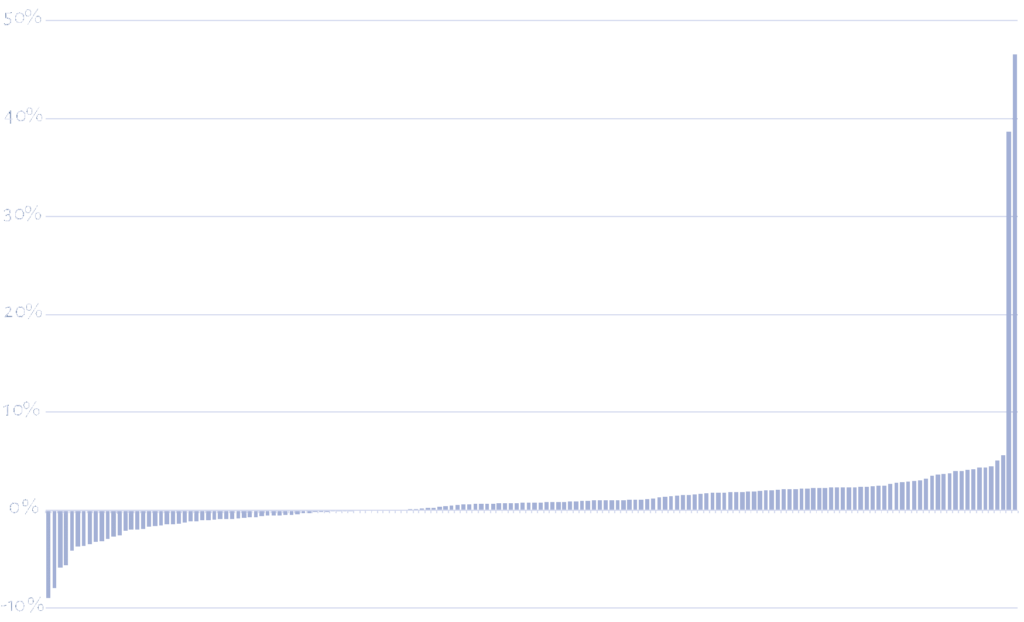

Pure tail-hedge strategies like long volatilty offer a hedge for risk assets in periods of severe market stress. In the much longer periods of average volatility, on the other hand, they generate high costs. Due to the overall negative expectancy, typical long volatility products are to be closed worthless at some point and be relaunched - they are therefore only suitable for short-term use. FTC's SMART VOLATILITY PLUS offers a tail hedge for stress scenarios such as the Lehman bankruptcy in the fall of 2008 or the Corona pandemic in 2020 and an alternative equity exposure during average market phases. The combination leads to a positive long-term expectancy.

Volatility Long & Short

SMART VOLATILITY PLUS applies two quantitative and systematic strategy groups that trade volatility futures: In most market environments, those strategies are active which skim risk premiums through short volatility exposure. In stress phases, which are always characterized by backwardation in the term structure of volatility futures, short-term and highly weighted long volatility exposure is built up. In combination, we expect a highly positive correlation to the equity market in average market phases and negative correlation and high excess returns in stress markets.

Figure: Distribution of the back-tested monthly returns between 2007 and 2020 (sorted by performance). The simulated performance is no reliable indicator for future returns. Source: FTC Database.

Hedging instrument and alternative solution to get equity exposure

With its overall positive expected return and expected asymmetric payout profile with high excess returns in pronounced stress markets, SMART VOLATILTY PLUS is suitable for hedging conventional equity investments against extreme market downturns. However, it can also be used as a (partial) substitute for the equity component in a diversified portfolio

Price & Performance

Smart Volatility Plus (EUR R01 T)

ISIN: AT0000A2SRK1

as at 26.07.2024

112,12 €

Compared to the last NAV

0,16 %

Month

-1,02 %

Year to Date

2,43 %

1 Year

7,01 %

3 Years

n.a.

Inception to Date

13,08 %

Marketing communication. The performance is calculated according to the OeKB method. The performance takes into account the management fee. The one-off front-end load of up to 3% that may be charged at the time of purchase, depending on the distribution channel, and any individual transaction-related or ongoing income-reducing costs (e.g. account and custody account fees) are not included in the presentation. Past performance is not a reliable indicator of a fund's future performance. Source: FTC Database.

The SMART VOLATILITY PLUS shows increased volatility.

SMART VOLATILITY PLUS may invest substantially in exchange-traded futures and demand or callable deposits with maturities of 12 months or less.

The computer system used by FTC employs certain strategies based on the reliability and accuracy of analytical models. If these models (or their underlying assumptions) prove to be incorrect, the performance of the SMART VOLATILITY PLUS may not meet expectations, which could result in substantial losses to the SMART VOLATILITY PLUS and, therefore, to investors.

Investment Information

DOMICILE

Austria

LEGAL CONSTRUCTION

UCITS

INVESTMENT COMPANY

Erste Asset Management

CUSTODIAN

Erste Group Bank AG

MANAGER

FTC Capital GmbH

AUDITOR

Ernst & Young GmbH Vienna

LIQUIDITY

Daily

SHARE CLASSES | ISINs | BB TICKERS

EUR R01 T1 | AT0000A2SRK1 | SMPEREA

EUR R01 VT2 | AT0000A2SRL9 | SMPERRE

EUR I01 T1 | AT0000A2SRF1 | SMPEIIE

EUR I01 VT2 | AT0000A2SRG9 | SMPEIEA

EUR I02 T1 | AT0000A2SRH7 | SMPEII2

EUR I02 VT2 | AT0000A2SRJ3 | SMPEI2E

1accumulating;

2accumulating in complete extents for tax non-residents;

MINIMUM INITIAL | SUBSEQUENT INVESTMENT (EUR)

Class R01: No minimum

Class I01: 250.000,- | 25.000,-

Class I02: 1.000.000,- | 100.000,-