Classic CTA profile enhanced with recent innovations

Managed Futures, also known as Commodity Trading Advisors (CTAs), date back to the 1960s and, because of the consistent characteristics, are considered an asset class of their own. Possibly the most important: The highest profitability of CTAs is expected during bear markets.

Broadly diversified by assets and strategies

The dominating strategy in the FTC Futures Fund Classic is trend-following. The original trading system dates back to 1995, but has since been continuously refined into a set of strategies diversified across different time frames. Additionally we apply short-term models and opportunistic strategies for further diversification. The current blend of strategies shows a highly positive correlation with common CTA benchmarks (such as the Barclays CTA Index or the SG Trend Index) leading to a reliable payoff profile: Superior returns in persistent, volatile market trends, particularly high returns in prolonged stress markets such as between 2007 and 2008. The current diversification by strategies is complemented by a broad diversification across all liquid asset classes: Commodities, currencies, equities, bonds and short-term interest rates.

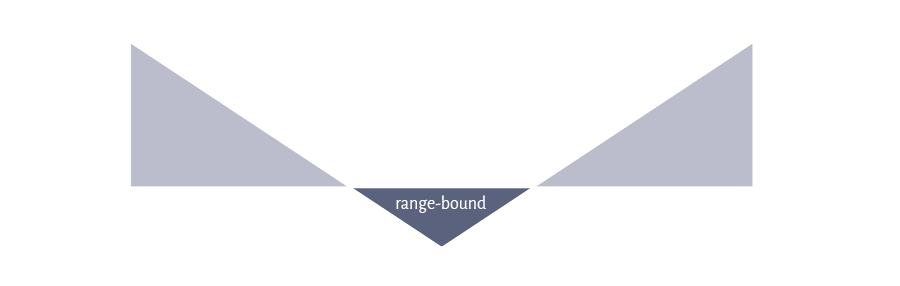

Figure: The expected payoff profile of CTAs is similar to that of a "long straddle" in options trading: profits are expected during pronounced trends with relatively high volatility, losses during (volatile) sideways phases.

Stocks and CTAs: "A match made in heaven"

Adding trend-following CTAs to traditionally constructed portfolios of stocks or stocks and bonds improves risk-return ratios - this observation, subsequently often confirmed, was made as early as 1983 by John Lintner, Harvard University economics professor and co-founder of the Capital Asset Pricing Model. Most recently in 2017, Hurst, Hua & Pedersen analysed data from 67 markets since 1880 for their study "A Century of Evidence on Trend-Following Investing" and found, among other things, that momentum would have performed well in eight of the ten most severe crises, defined by the largest drawdowns of typical 60/40 portfolios. However, in trendless markets or in the event of frequent trend reversals, investors of momentum driven strategies should expect drawdowns which can be significant.

Price & Performance

FTC Futures Fund (C EUR)

ISIN: LU0888918488

as at 21.10.2024

17,37 €

Compared to the last NAV

-1,86 %

Month

-3,55 %

Year to Date

-9,11 %

1 Year

-15,52 %

3 Years

-13,41 %

5 Years

10,85 %

10 Years

n.a.

Inception to Date

-13,28 %

Marketing communication. Performance data was calculated according to the OeKB method. Performance data takes the management fee into account. The front load of up to 4.5% that may be payable on purchase, depending on the distribution channel, as well as any individual transaction-related or ongoing income-reducing costs (e.g. account and custody account fees) are not included in the presentation. Past performance is no reliable indicator for future results. Investors should expect increased volatility.

Class B USD: Performance might be effected by currency rate changes (from the perspective of an investor whose calculation currency is non-dollar).

Class C EUR: Launch of the share class was February 3, 2018; the performance before is based on the net performance of the retail class B EUR (= performance before management and performance fees) and the actual fees of the institutional class C EUR.

FTC Futures Fund Classic may invest substantially in exchange-traded futures and demand or callable deposits with maturities of 12 months or less.

Investment Information

DOMICILE:

Luxembourg

LEGAL CONSTRUCTION:

AIF SICAV

ADMINISTRATOR:

EFA - European Fund Administration (LUX)

AUDITOR:

Deloitte (LUX)

AIFM:

FTC Capital GmbH

LIQUIDITY:

Daily (banking days)

CUSTODIAN:

Quintet Private Bank (LUX)

SHARE CLASSES | ISIN | BB TICKER:

C EUR (Institutional) | LU0888918488 | FTCFUCE LX

B USD | LU0550775927 | FTCFUTU LX

B EUR (Retail) | LU0082076828 | FTCFUTF LX

DISTRIBUTIONS:

None (accumulating)

MINIMUM INVESTMENT:

100.000,- (C EUR)

25.000,- (B USD)

Legal Information

The contents of this web site are marketing communication. They shall be used exclusively for information purposes and represent neither by Austrian nor by foreign financial market law a solicitation, an offer or an acceptance for the conclusion of a business transaction or any other form of legal act, in particular an investment, and should not influence any such decision. No investment should be made without consultation. The contents must not be interpreted as financial consulting, legal advice or tax consulting. FTC Capital GmbH has provided all information with the highest possible care, using only sources deemed to be reliable. Nevertheless, FTC Capital GmbH accepts no liability for the accuracy, integrity, actuality or ongoing availability of the information provided on FTC’s website.

FTC Capital GmbH accepts no liability for loss or damage, including lost profit or any other direct or consequential damages, arising from the use of or reliance on the information provided on this website. Publishing of information contained therein is prohibited.

Future investors should make use of adequate investment consulting and should acquaint themselves with the applicable legal bases, exchange supervisory authority laws and taxes in their home country or country of residence. In any case, current legal fund documents (offering memorandum, annual reports, semi-annual reports, etc.) should be studied carefully. All fund-specific documents can be ordered free of charge from FTC Capital GmbH, Seidlgasse 36/3, A-1030 Vienna, and from the respective agent (representative) in countries where the funds are registered for public distribution. On request we will announce further institutions which provide fund specific documents as well as the date of the last publication of the offering memorandum in Austria or in jurisdictions in which the funds are authorised for public distribution.

Authorisation for public distribution:

Austria, Luxembourg; in particular public distribution is not allowed in Germany or Switzerland

Information for the USA:

Investment products and information mentioned on the following pages are not intended for distribution in the US.

Therefore, they do not apply to US residents according to Rule 902, Regulation S, Securities Act 1933 (in particular American citizens or persons permanently resident in the US).

Information for Germany: